Case Study 1: Developing a Fintech Proposal Deck to Empower Ghanaian Small-Scale Businesses

Client Overview

A forward-thinking fintech company seeking to revolutionise financial operations for small-scale Ghanaian businesses by offering solutions for everyday financial management and idle capital optimisation. The company aims to streamline processes, making business banking more accessible and efficient.

Project Scope

Content Problem Statement

Opening and managing a business account in Ghana presents significant challenges for enterprises. On average, businesses face a five-week timeline to activate their accounts, followed by an additional three-day wait to receive a debit card. International transactions are constrained by limited functionality, delayed processing, and prohibitively high fees. Moreover, idle capital management poses another hurdle. Businesses seeking to optimize unused funds for interest gains are required to open separate investment accounts, adding further complexity to an already cumbersome process. The current system lacks a customer-centric approach, creating inefficiencies that do not align with the dynamic needs of modern businesses.

Content Solution

The objective was to create a versatile nine-slide master deck to serve multiple purposes, including:

• Investor presentations

• Internal strategy alignment

• Business development engagements

The deck needed to communicate key concepts clearly while remaining adaptable for different audiences. The client requested a simple yet professional approach, using a basic color scheme and avoiding elaborate design elements.

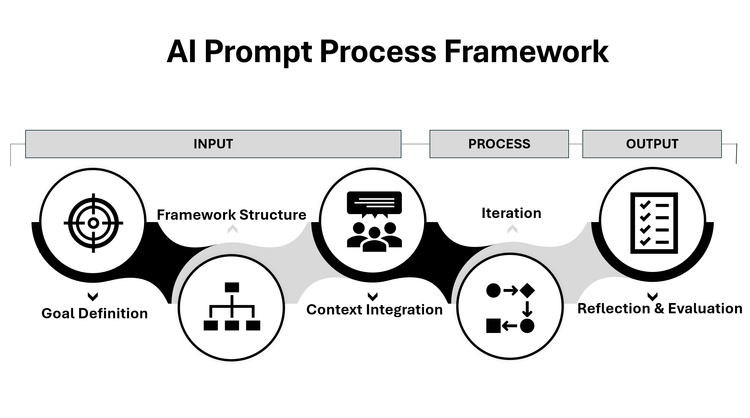

Framework

The approach centered on establishing two primary objectives:

-Enhancing Daily Financial Operations (Short-Term Benefits): The solution emphasised a user-friendly platform leveraging a central repository to provide businesses with a comprehensive view of their financial activities. This repository functions as a one-stop solution, streamlining daily operations by offering convenient, efficient, and timely access to essential financial tools and insights.

-Optimising Idle Capital (Long-Term Benefits): The fintech’s strategy highlighted the importance of multi-currency functionality to maximise the value of idle capital. By facilitating seamless utilisation of funds across currencies, businesses can mitigate opportunity costs and enhance financial agility over the long term.

Key Highlights

• Tailored Storyline: A structured narrative that balanced strategic goals, market insights, and customer-centric solutions.

• Simplicity with Impact: Prioritized clarity and direct communication, ensuring a professional yet engaging presentation.

• Flexible Design: Minimalist design enabled seamless updates and audience-specific customisations.

Outcomes

The final deck positioned the fintech as a credible and innovative player in the Ghanaian market, effectively communicating its vision to internal and external stakeholders. The collaborative process also strengthened strategic alignment between the client and key partners.

Conclusion

This project underscored the complexities of doing business in Ghana and the need for innovative financial solutions. It was a rewarding experience working with a visionary client dedicated to transforming the business banking landscape. The deck not only met the client’s objectives but also highlighted the opportunity for significant market impact. Looking ahead, this solution has the potential to redefine how Ghanaian businesses engage with financial services—simplifying operations and fostering growth in a challenging environment.

Member discussion